What kind of people make use of cash advances?

The online payday cash advances industry advertises these Payday On line as quick and easy ways to get money, and targets low-income working people, including welfare-to-work women, military personnel, and others who have little to no savings and live from one paycheck to the next. Most people who apply for these loans have a hard time paying them off, and end up rolling over their payday personal loan and paying renewal fees a multitude of times. Trapped on this debt treadmill, shoppers typically pay much more in fees than the amount they originally borrowed.

Even though cash advance loan are marketed as one-time assistance during a financial emergency, a 2003 study by the Center for Responsible Lending found that 91% of all payday cash advance are made to borrowers at least 5 payday personal loan a year. Borrowers, on average, receive 8 to 13 cash advance loans from a single payday lender in a year. And, most payday borrowers go to more than one lender, dramatically increasing their total number of payday loans per year. A mere one percent (1%) of all cash advance loans are made to first time emergency borrowers.

Nonetheless the personal cash advance market still lives due to the fact that it is The only source of boon in some financial situations.

What do the lenders base who they loan a cash advance payday personal loan to?

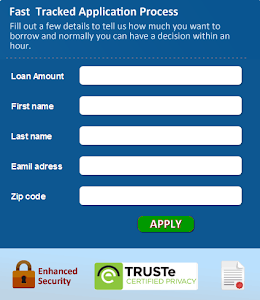

In order to qualify for a payday cash advance, most consumers only need to show personal identification, have a personal checking account, and provide proof of income from employment or government benefits, such as Social Security or disability payments. Unlike conventional lenders, payday lenders do not look at a borrower's monthly expenses or her ability to repay the requested loan.

What is a Payday Cash Advance Loan?

Payday loans and cash advances. To get a cash advance loan, a borrower gives a personal loans online lender a postmarked personal check or an authorization for automatic withdrawal from the borrower?s bank account. In return, he receives cash, minus the lender's fees. To start..., with a $300 Payday Cash, a purchaser might pay $45 in fees and get $255 in cash.

The lender holds the check or electronic debit authorization for a week or two (usually until the borrower's next payday). Then, the person who is borrowing has a choice of (1) pay the full amount, (2) let the lender deposit the full amount, or (3) renewing or rolling over the loan, if he is unable to repay it. Most payday lenders accomplish the same effect with back-to-back transactions, by making the payday borrower make out another personal check for a new cash advance, and using these funds to pay off the prior loan. In renewal and back-to-back transactions, the person who borrows gets no new cash, but another fee.

In any case, cash advance has aided many people in hard circumstances and hence the business persists in.

What is the fee for getting a payday loan?

Payday loan, a borrower will pay at least fifteen dollars for every $100 borrowed. However with such a short amount of time these funding fees amount to roughly a 400% annual percentage rate (APR).

0 comments:

Post a Comment