A person earning a regular monthly wage is bound to encounter some financial contingencies at some point in his career. Indeed, average working individuals usually encounter these money issues so you should get used to it. Knowing how to face such financial challenges will make all the difference. Basically, when it comes to a financial dilemma, applying for a loan is one of the best options. The question here is on the most suitable type of loan you should apply for. For the average earning individual, taking out a payday loan can be considered as one of your better decisions. Let's discuss a few important points on why this type of loan can properly address your current financial needs.

One, a payday loan is designed so that the borrower would be able to address urgent financial needs that are not very substantial. In other words, the amount involved may only be just as much as your monthly salary which is enough to cover for such expenses. It's certainly not like the amount expended for the purchase of a house or other real estate like when you apply for a mortgage loan. Next, applying for a payday loan is so much easier s compared with other loan types and you get approved faster. Usually, payday loans only have minimal requirements and lending institutions do not even require you to show proof of your credit rating and history.

Thirdly, a payday loan application can be processed quickly and you get the funds almost instantly. Once the essential requirements have been met, it takes one to three days maximum for the loan to be granted. This is perfect when you need the money immediately for contingencies like emergency household repairs or when your car battery just conks out on you. Lastly, a payday loan is easier to pay back compared to other types of loans. That's because the amount involved is not that substantial and you can even pay it back in full if you want on your next pay check. But it's also only natural that there will be setbacks as well like higher interest rates and shorter payment periods since this loan is an unsecured one.

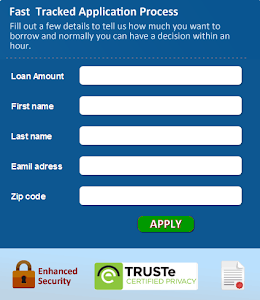

Since it is an unsecured loan, a payday loan does not require any collateral or security to back it up. For this reason, the lender is given the incentive with higher rates of interest plus a shorter period of time for payments. But on the bright side, you are still benefited by such an arrangement since you only need a shorter period of time to pay for your debt. Now when you want to apply, your best option is to go online. Online payday loan sites provide for more efficient methods to process your loan, particularly since you can do this wherever you may be. Even if you're at home or in the office, you can go ahead and comply with the necessary requirements and process your loan. That's how convenient it is to secure your needed funds all thanks to the powers of web technology.

0 comments:

Post a Comment